Problem :

In current world, we might faced the difficulties of keeping money in form of cash, cheque, or debit cards in our hand during lost, theft or fraud.

Background :

Where is the source for our day-to-day money comes from ?

All of the people are earning money as the remuneration of the their work or service.

That money is received as salary/profit to their personal bank accounts. So we can assume that the personal bank account is the first entry point of our money.

Why we are keeping money with our hands out from bank accounts?

- for Purchases or Settlements

So where are these money going finally ?

If we look at the flow of our money, it looks like below :

Our bank account -> Our hand -> Merchant's hand -> Merchant's bank account.

Where are these lost/theft/ fraud happening ?

From the withdrawal of the our bank account till depositing to Merchant's bank, within that it can happen.

Solution :

What is nCbC ?

nCbC is a web application, any Consumers or Merchants can register & keep their accounts in there. An nCbC account can have many bank accounts for their accounts in many banks, And nCbC will verify those account details using a secure process which involves both person & bank. nCbC can be accessed by Consumers using web/smart device (phone/tab etc..) or by Merchants using their POS (point of sale) / web. Above accesses will be encrypted and fully secured. And nCbC system will have trusted & secure communication with related banks directly or using gateways.

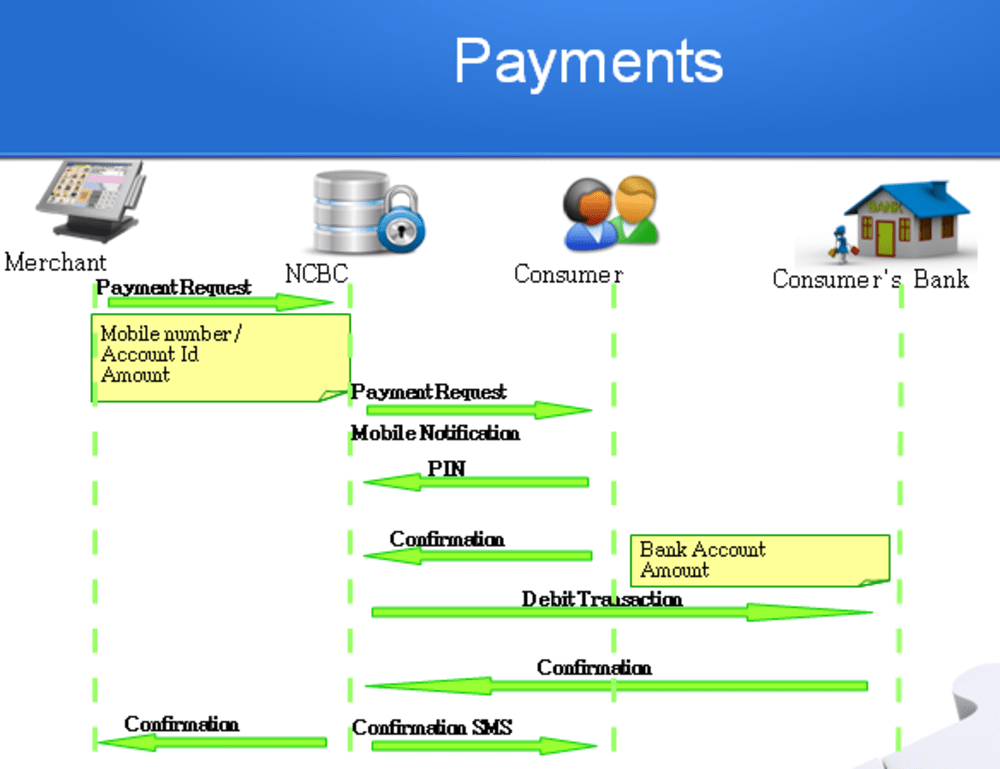

How nCbC will help in Purchases?

- Merchant will initiate the payment request by entering consumer's Mobile number/nCbC id & purchased Amount.

- Consumer will get a mobile notification, that you received a payment request with Merchant name & Amount, which consumer can accept or reject with his PIN code.

- nCbC will do credit transaction on consumer's bank account & give transaction confirmation notification to both Consumer & Merchant.

- nCbC will do settlements for merchants daily / weekly or monthly based on the agreement.

How the problem get solved by using nCbC ?

Since, nCbC doing the job to transfer the money from Consumer's bank account to Merchant's bank account using secure communication, the time of being cash in hand is coming to zero. This will help from the fraud.

How nCbC differs from card payment ?

To get the benefits from each bank, we might have many bank accounts. If we use existing card payment, we should have separate cards for each bank. But nCbC reducing that maintenance by having only one nCbC account with multiple bank accounts.

Why nCbC can become future payment mechanism ?

The world is now converging into two things :

1) Smart Device

2) Internet

Since nCbC is fully designed based on both, this might be the future payment machanism.

Like this entry?

-

About the Entrant

- Name:Varatharaja Kajamugan

- Type of entry:individual

- Software used for this entry:php

- Patent status:pending