Problem description

There so many credit cards and their variants available in the market along with associated services and offers. From the end user's view it makes it nearly impossible to utilize the best available option also it creates an overhead to maintain so many cards.

It adds up to the cost incurred by companies to produce and market cards.

The innovative solution

The above problem can be reduced greatly with incorporating better services for customer and opportunity for card providers using this product.

What is the product or service:

It is a combination of product and services.

The physical product is the OneCard. It would be an electronic card.

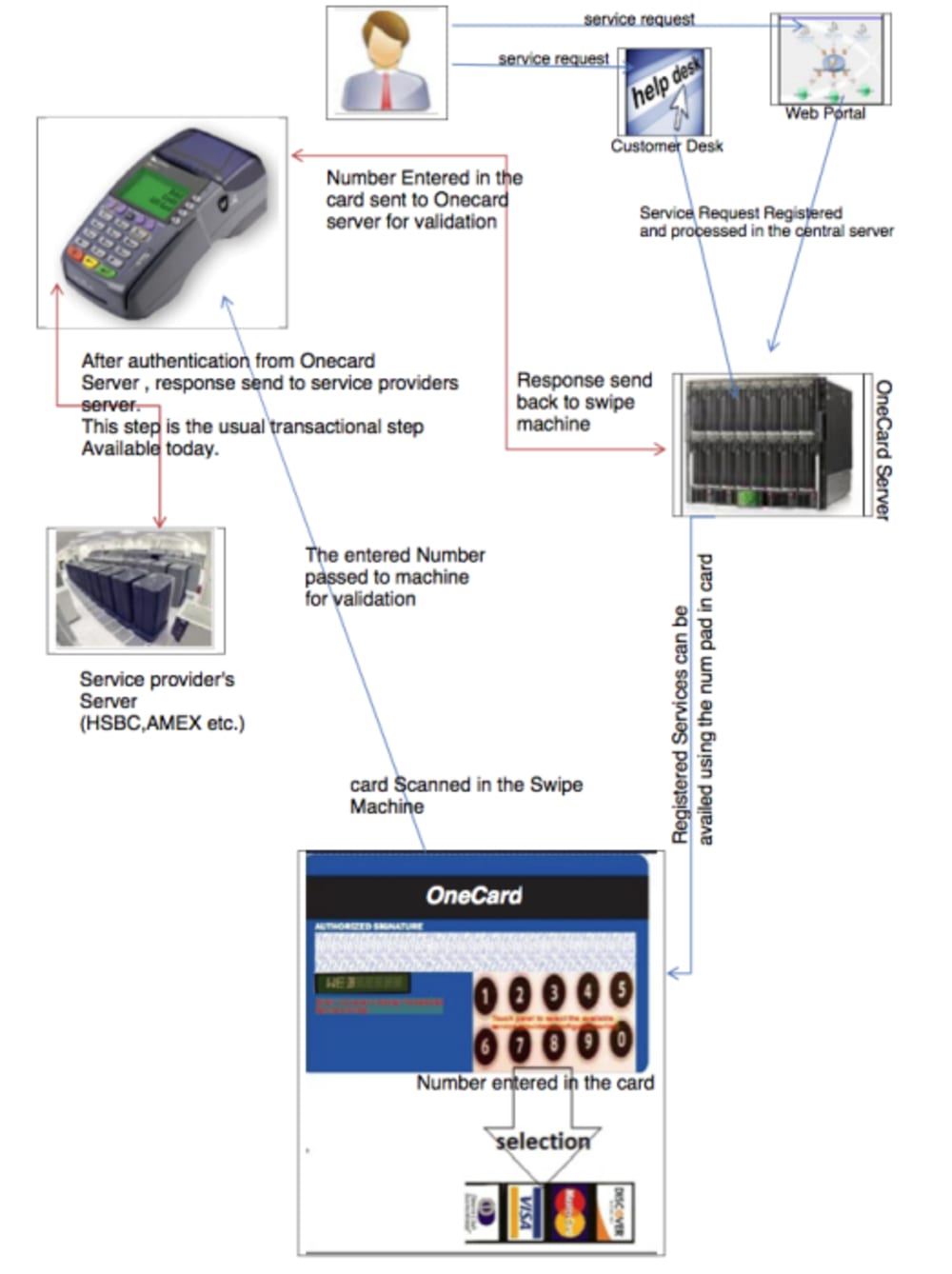

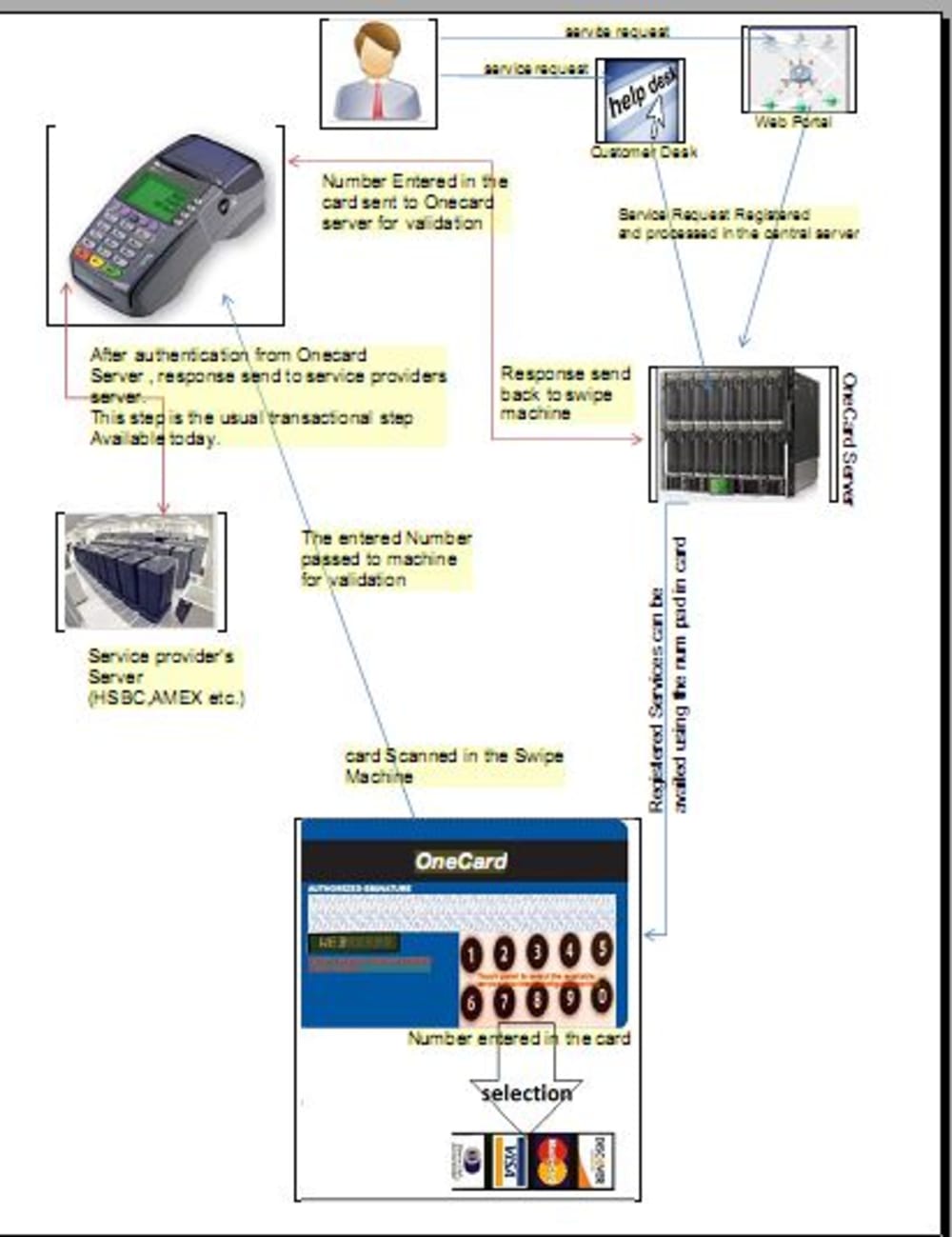

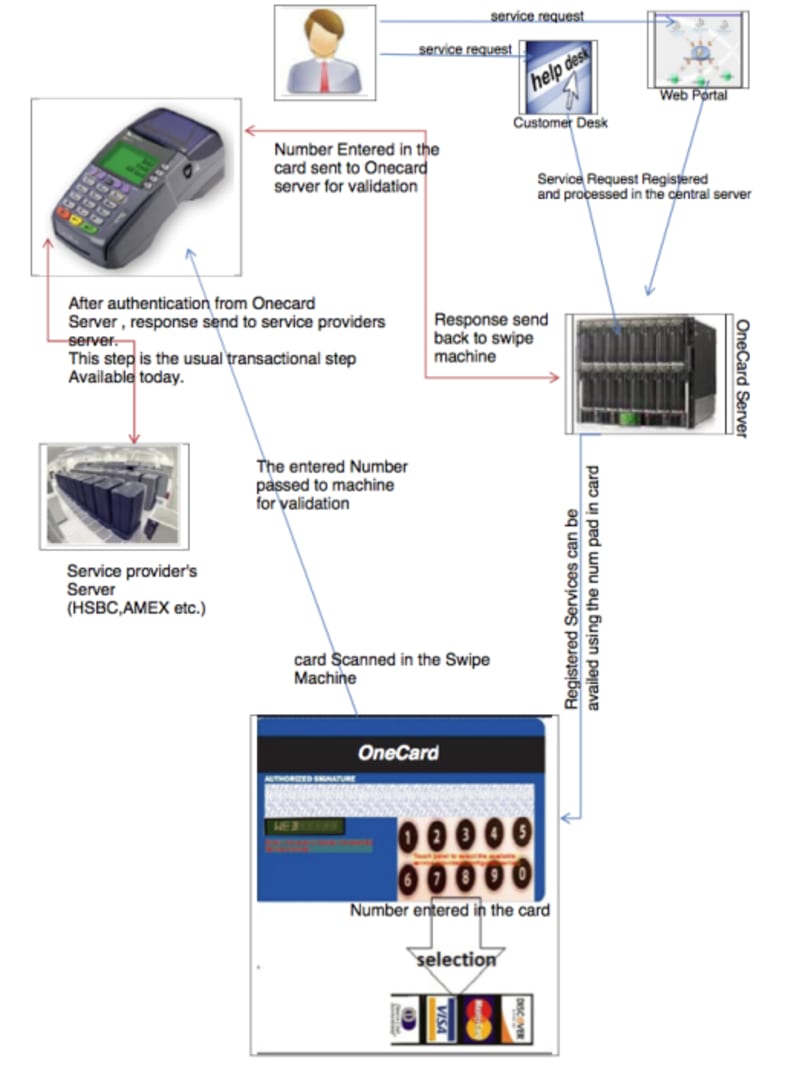

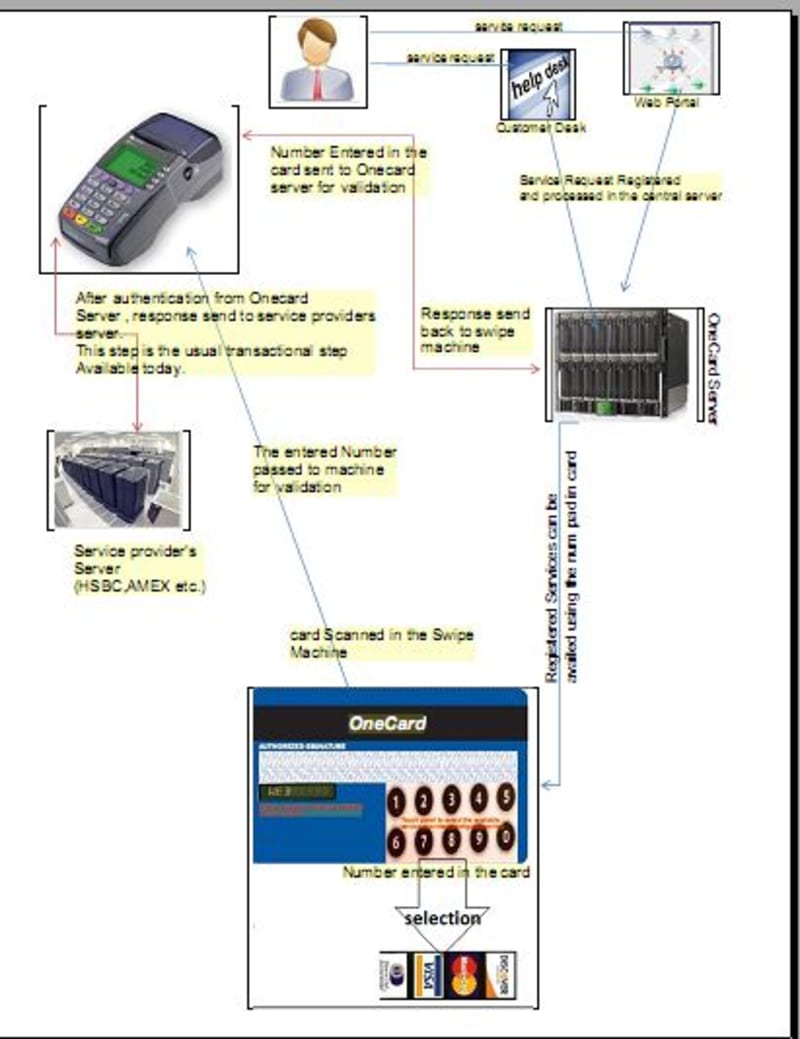

This card can be configured from the customer service desk, or an online web portal to make the card accept one or more services. A centrally located database needs to be updated for every service addition or removal.

Now the service provider can be selected by using the controls on the card on the fly by customer. It aims at seamlessly unifying all the banks, retail services, and credit card associations etc.

The uniqueness and innovativeness

The end user: He does not need to keep different cards for different services he uses.

The banks: The banks will benefit in a manner that they need not issue a card every time an account is opened in their bank. If the customer has a OneCard, it can be configured to accept the services of this Bank account or credit card.

The retail service providers: The organizations like pantaloons or walmart, with the help of this service will be assured that the cards they issue would have more chances of being used.

Card associations (Visa/Master Card): Reduced number of cards required per year which is a cost for them, and they can continue with the processing service they are into, which generates the major revenue for them.

Potential customers

1. People with accounts in any bank for more than one year who have a good track record

2. The banking services companies

3. Card associations

4. Large retail houses, airlines, hotels, or any other institutions which issues cards to customers

5. Government bodies

6. Insurance companies

Manufacturability & Cost Effectiveness

This is pure application of available technology into an innovative service, the major cost incurred will be in creating value in services. This will not require great capital investment.

Market size

The addressable market would span in the hundreds of millions as the end customer and hundreds of institutions like banks and retail houses or the government organizations. With more and more card users added every day, the growth rate of the market is very high.

Revenue Mechanism

We expect to earn from a very small per transaction or fixed price type use of the service from the banks and the retail stores. We do not intend to charge the end user directly. Moreover the banks and retail stores would end up cutting a lot of their expenses by the use of this service.

Like this entry?

-

About the Entrant

- Name:Pranav Singh

- Type of entry:individual

- Hardware used for this entry:MacSoftware used for this entry:Adobe Image ready ,foxit

- Patent status:none